FarmBooks Tax Planning Reports

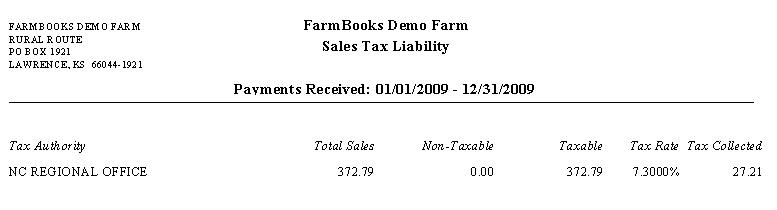

Sales Tax Liability

This report summarizes the sales tax you’ve collected and currently owe to your tax authorities. The report shows your total taxable sales, non-taxable sales, and the amount of sales tax you owe each tax authority in the column called tax collected. If you collect sales tax for more than one tax authority (city, county, state), each one has its own line in the report.

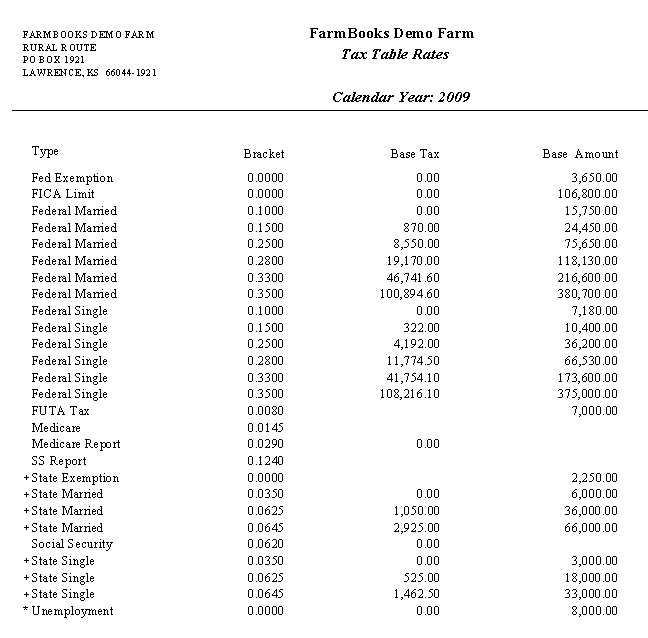

Tax Table Rates

The Tax Table Rates report lists the rates used for calculating tax withholdings for salaried employees and entering paychecks for hourly employees. Farm Auto and Farm Utility percentages will vary by user. State taxes will vary depending on your operating state.

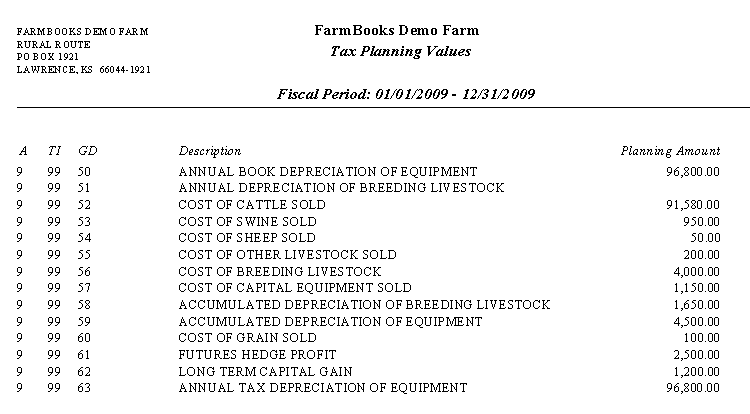

Tax Planning Values Report

The Tax Planning Values report lists specific estimated financial and tax planning values to be used in providing preliminary Schedule F and Net Taxable Income Statements. The Annual Depreciation of Equipment value is also used in the Income Statement report.

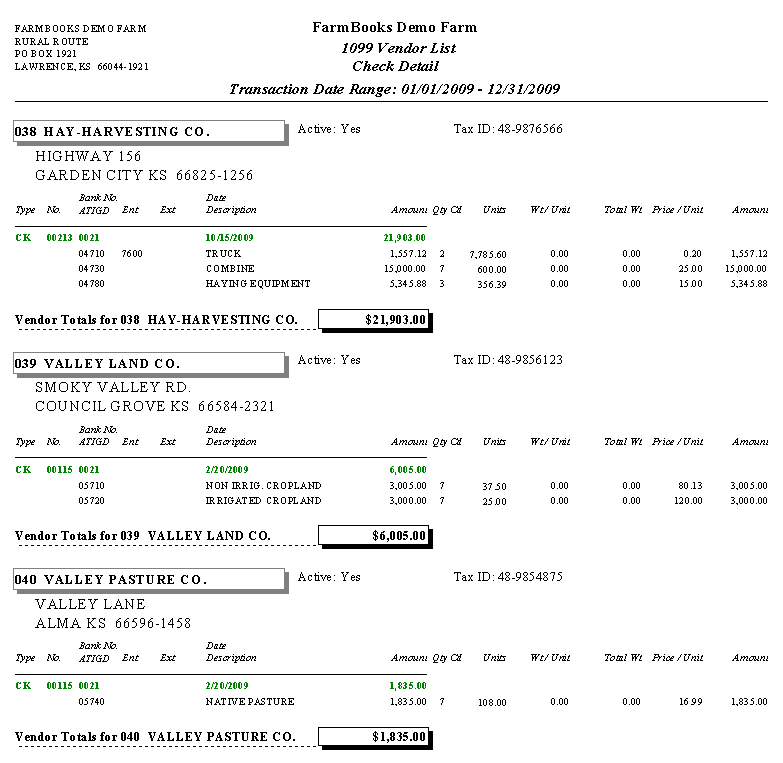

1099 Vendor List

There are two 1099 reports that help prepare you for your 1099 tax reporting requirement.